Insurance Companies Fight Paying Billions in Claims

Put yourself in the driver’s seat of this accident. You are heading down the street when a truck comes out of nowhere and slams into the right side of your car. The damage to the vehicle is obvious: dents across the passenger door.

You are hurt too, though it’s not obvious how much: a slight cut above your eye, an ache in the neck. Your doctor says your spine was injured, you have soft muscle tears, and the pain in your neck mostly likely is whiplash.

It’s going to need therapy, she says, and some time off work to heal. And in the end it’s going to cost you $15,000 in medical payments and another $10,000 in lost wages, because you took so much time off work.

But when you send the $25,000 bill to the insurance company of the person who hit you, the insurance company says it’s only going to pay you $15,000. You can take it or leave it.

We will work tirelessly to help you recover the compensation you need to move forward with your life

What Do You Do?

That’s what producer Kathleen Johnston and I have been investigating for the last 18 months — accidents most of us don’t pay attention to, the fender-benders we pass by without even slowing down. In part, we looked at how Allstate handled the claim of one woman, Roxanne Martinez. Her car was hit in Santa Fe, New Mexico. Her medical bills and lost wages added up to $25,000.

Allstate offered $15,000 to settle. Roxanne Martinez didn’t know what to do.

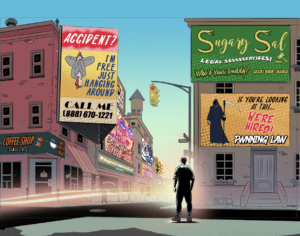

Sure, she could try to find a lawyer. But if you were in her shoes, would you? After all, you are fighting insurance giant Allstate over a $10,000 difference. What attorney is going to take on that case?

Martinez’s case represents what 10 of the top 12 auto insurance companies are doing to save money. And if you are in a minor impact crash and get hurt, former insurance industry insiders say, insurance companies will most likely try doing the same thing to you: delay handling your claim, deny you were hurt and defend their decision in drawn-out court battles. It’s the three Ds: delay, deny and defend.

That, in a nutshell, is the strategy adopted by several major auto insurance companies over the past ten years, a lot of lawyers, former insurance company insiders and others tell CNN.

With nowhere to go, Allstate and others bet you’ll take what they offer and walk away. It’s right in the training manuals we obtained from Allstate: force “smaller walk-away settlements.”

Shannon Kmatz, a former claims adjuster for Allstate, told us she would offer as little as $50 dollars in some cases. Poor people would take it, she said, fearing that if they didn’t, they’d get nothing at all. Roxanne Martinez didn’t take it. She sued and a jury awarded her $167,000 dollars. But that verdict took three years.

Allstate is betting you won’t wait, you won’t sue and you’ll take what you get and walk-away. And that, say our experts, has been a good bet for Allstate and others. Accident victims have been walking away from billions of dollars that insurers now keep for themselves.

Allstate would not grant an interview or answer our questions. Instead, they sent an e-mail saying they didn’t think CNN would deliver a fair report.

By Drew Griffin, CNN Correspondent

We believe that our experience, dedication, and personalized approach set us apart from the rest.